- Home

- Risk Management Report

Risk Management Report

CHAIRMAN OF BRC MESSAGE

Statement: “With a clear vision of where we want to be heading and an elaborate risk appetite framework, AfrAsia Bank is fully prepared to manage and mitigate the risks and challenges across the various products we offer and in the various markets we operate.” We live in a risky time in which the global economy has been propped up by unprecedented monetary stimulus and the emergence of a new global economic and political order. At AfrAsia, our attempt is to keep risk at the core of our decision making and keep sharpening the tools to navigate our way through ‘known unknowns and unknown unknowns’, to borrow a phrase from Donald Rumsfeld.

ARVIND M. SETHI – CHAIRMAN OF BRC

HEAD OF RISK STATEMENT

“Taking risk is inherent to the Financial Institutions, but such risk taking needs to be made in an informed, calculated and disciplined way, and within a pre-determined risk appetite and tolerance. This is the primary objective of AfrAsia Bank risk management strategy and framework.”

CHUNDUNSING (RAKESH) SEESURN – HEAD OF RISK

RISK MANAGEMENT STRATEGY

OUR VISION

OUR MISSION

GUIDED BY RISK APPETITE MANAGEMENT

Stress-Testing

Stress-testing (ST) is an integral part of the Bank’s risk management process as it consists of both sensitivity analysis and scenario analysis.

Stress testing is a fundamental tool to

- facilitate a view of the organisation’s forward risk profile as a result of portfolio effects and/or changes in economic conditions;

- Identify potential vulnerability to unprecedented but plausible events; and

- Determine appropriate management actions or contingency plans to limit the impact of such events on the entity;

Results of stress testing must impact decision making, including strategic business decisions via

- Strategic planning and budgeting;

- Internal Capital Adequacy Assessment Process (ICAAP), including capital planning and management, and the setting of capital buffers;

- Informing the setting of risk appetite statements;

- Liquidity planning and management; and

- Identifying and proactively mitigating risks through actions such as reviewing and changing risk limits, limiting exposures and hedging;

The various type of scenario analysis performed at ABL are as follows:

- Changing multiple risk inputs simultaneously with the source of the stress event being well defined;

- Macroeconomic stress testing involves the creation of a severe but plausible macroeconomic scenario and assessing the impact of key macroeconomic risk drivers (e.g. GDP, interest rates, inflation) on key risk inputs (e.g. PD, LGD and EAD);

- Other hypothetical or historical scenarios: “what-if”;

- Assessing the impact on income statement, balance sheet and capital ratios;

- Move of a risk parameter, or a small number of very closely related risk parameters to understand the impact on a risk position;

- It is important to note that the event that gives rise to the movements in the parameters is hypothetical;

- Entities to assess scenarios and circumstances that would render its business model unviable, thus identifying potential business vulnerabilities

Starts from the point of failure of the organisation’s business model and then working backwards to identify circumstances or scenarios under which this might occur;

Point of failure is considered as significant financial losses that impact the Bank’s capital or lack of liquidity to such an extent that the existing business model would no longer be viable or where material supervisory intervention would result.

Risk Weights

Committees established by the Board of Directors

Credit Committee

- The Board Credit Committee (BCC) consists of 2 nonexecutive directors, and 3 independent non-executive directors, who are experienced credit & risk professionals with extensive experience in emerging markets and Mauritius.

- The BCC is a consultative as well as an approval panel for facilities exceeding the Management Credit Committee’s lending authority as defined in the Credit Risk Policy. In this capacity, the BCC examines and approves large credit applications where global exposures exceed MUR 50M.

Risk Management Committee

- The Board Risk Committee (BRC) composes of the chair/independent non-executive director, 1 independent nonexecutive director, 2 non-independent non-executive directors and 1 executive director. They all met four times during the year for review.

- The BRC reviews the principal risks and has a global view on all risks that the Bank faces. It oversees that appropriate actions are being taken to mitigate or avoid these risks, all in compliance with Bank of Mauritius guidelines and policies approved by the Board. The BRC also ensures that transactions which could materially affect the financial stability of the Bank are identified at source and that liquidity ratio is maintained at all times.

Conduct Review Committee

- The Conduct Review Committee (CRC) composes of 3 independent nonexecutive directors. They met four times during the year for review.

- The CRC reviews the practices of the financial institution and approves credit exposures to related parties. It ensures that market terms and conditions are applied to all related party transactions. It also reports on a quaterly basis to the Board on matters it has reviewed, including exception on policies, processes and limits.

Audit Committee

- The Audit Committee compromises of three non-executive independent directors, who met four times during the year for review.

- The Audit Committee's principal responsibilities are to ensure that the Bank implements and maintains appropriate accounting, internal control and financial disclosure procedures, evaluate and approve the related procedures. It can also have consultations with both the Bank’s internal and external auditors, as required.

Corporate Governance Committee

- The Corporate Governance Committee (CGC) consists of 1 independent nonexecutive director, 3 non-independent non-executive directors and 1 executive director, who met 8 times during the year.

- The CGC has the responsibility to deal with all Corporate Governance issues and make recommendations to the Board in accordance with the National Code of Corporate Governance 2016.

Committees established by Management

Management Credit Committee

- The Management Credit Committee (MCC) reports to the BCC and comprises of three voting members (Chief Executive Officer, Head of Credit Risk and Head of Risk with veto rights on policies.

- The MCC assists the Board to formulate, approve and implement loan policies, guidelines and credit practices of the Bank. It is also responsible for the implementation and maintenance of the Bank’s credit risk management framework. The key objective of the MCC is to evaluate, review and sanction credit applications up to MUR50M and those referred by lower mandates or, which cannot be sanctioned at lower levels.

Assets and Liabilities Committee (ALCO)

- This committee, which comprises the Chief Executive Officer, Chief Financial Officer, Head of Risk, the General Manager, Senior Executive - Head Corporate Banking, Senior Executive - Head of Global Business, Senior Executive - Treasury and Markets, Head of Credit Risk and Head of Treasury meets at least once a month.

- The Bank’s Assets and Liabilities Committee’s overall responsibility is to ensure that the Bank’s overall asset and liability structure including its liquidity, currency and interest rate risks are managed within limits and target

Committees

MANAGEMENT OF KEY RISK AREAS

Definitions of Risk types

CREDIT RISK

Organisation and Structure

CREDIT RISK MITIGATION

As a fundamental credit principle, the Bank does not generally grant credit facilities solely on the basis of the collateral provided. All credit facilities are also based on the credit rating, source of repayment and debt-servicing ability of the borrower. Collaterals are taken whenever possible to mitigate the credit risk. The collateral is monitored on a regular basis with the frequency of the valuation depending on the liquidity and volatility of the collateral value.

Enforcement legal certainty of enforceability and effectiveness is another technique used to enforce the risk mitigation. Where a claim on counterparty is secured against eligible collateral, the secured portion of the claim is weighted according to the risk weight of the collateral and the unsecured portion against the risk weight of the counterparty. To mitigate counterparty risk, the Bank also requires close out netting agreements. This enables the Bank to offset the positive and negative replacement values of contracts if the counterparty defaults. The Bank’s policy is to promote the use of closeout netting agreements and mutual collateral management agreements with an increasing number of products and counterparties in order to reduce counterparty risk.

As an indication, claims secured by cash and other charges represent 70% of the asset book*, whilst unsecured portions account for 30% of total asset book.

| Collateral Detail | Total |

|---|---|

| Unsecured | 8,990,898,749 |

| Others | 7,166,876,269 |

| Claims on bank | 6,009,187,500 |

| Floating Charge | 5,033,654,613 |

| Fixed charge | 1,715,440,407 |

| Cash secured | 790,271,278 |

| 29,706,328,815 |

*exclusive of interest.

MARKET RISK

Market risk refers to the potential losses that arise from the adverse movement in market value of financial instruments triggered by changes in market variables. These variables include, but are not limited to, interest rates, foreign exchange rates, inflation rates, implied volatilities, credit spreads, and the prices of bonds, equities, commodities or derivatives. The key drivers of market risk that the Bank is exposed to is mainly associated with fluctuations in interest rates and foreign exchange rates.

Market risk, also known as “systematic risk”, typically affects the entirety of a market. As such, this risk cannot be fully eliminated through diversification but may be reduced using the various hedging products and techniques.

The Bank has in place a sound risk management framework to monitor and manage the market risks that the Bank is exposed to on a daily basis, a framework of limits and triggers as approved and regularly reviewed by ALCO (Asset and Liability Committee) and the BRC (Board Risk Committee) which is in line with the Bank’s risk appetite and complement the regulatory limits as established by the central bank.

The Market Risk unit, being responsible in identifying and monitoring the Bank’s exposure to market risks, works in partnership with business lines to efficiently define market risk policies and procedures. As part of the independent risk management structure, the Market Risk unit reports to the Bank’s Head of Risk. The objective of market risk management is to help control risk, facilitate risk-return decision-making, reduce volatility in operating performance and provide transparency into the Bank’s market risk profile to senior management, the Board of Directors and regulators.

Interest rate risk arises from the likelihood that movements in interest rates will affect future cash flows and the market value of financial instruments. The main approach used by the Bank to measure this risk is through a gap analysis and sensitivity analysis. The risk is managed as per the Bank’s interest rate risk policy.

The Bank uses a variety of risk measures to estimate the size of potential losses for both moderate and more severe scenarios, under both short-term and long-term time horizons.

Not all activities need to have the same limit structure and adequate market risk limits are established in accordance with the complexity of the activity and risks undertaken.

Market risk reports are regularly communicated to Senior Management, ALCO and the BRC highlighting all market risk matters and relevant issues are promptly escalated.

Value at Risk (VaR)

The Value at Risk is a statistical measure of risk that is used to quantify risks across products, per types of risks and aggregate risk on a portfolio basis, from individual trading desks up to the Bank level. The metric can be defined as the maximum loss that the Bank can incur during a given holding period under normal market conditions – at specific confidence levels.

The Bank has adopted a parametric approach to compute the VaR at a 99 percent confidence level using a 10-day daily volatility change. The holding period used is one day in order to proactively manage risk on a day-to-day basis.

Sensitivity Limits

Sensitivity limits are used to monitor the potential risks faced by the Bank due to changes in several pricing parameters. These measurements include Portfolio Duration limits and PV01 limits.

The PV01 is a measure of sensitivity to a 1bp (basis point) change in interest rates. The outcomes may be positive or negative reflecting the percentage change in value for a 1bp or a 100bp (PV100) rise or fall in interest rates.

Gross Position Limits and Transaction Limits

Absolute gross position limits are set up to mitigate concentration risk and ensure that the Bank is not overly exposed to one particular market, sector, or instrument.

These limits are usually referred to as portfolio restrictions upon creation of the portfolio. Many trading portfolios have limits on the amount of certain products that can be held in the portfolio and these are often due to liquidity issues (e.g. limits on the maximum $ amount or percentage of portfolio in corporate bonds, etc.)

Maturity Limits

The majority of fixed income products are contracts that expire at a certain date. In general, the mark-to-market valuations of these products are more difficult to obtain if the products have long-term maturity, low liquidity or low credit rating. Maturity limits are established for portfolios that trade those types of products.

ASSETS AND LIABILITIES MANAGEMENT (ALM)

- FOCUS ON LIQUIDITY RISK

- STOCK OF LIQUID ASSETS

- DEPOSITOR CONCENTRATION RATIO

- LIQUIDITY COVERAGE RATIO

-

FOCUS ON LIQUIDITY RISK

Liquidity risk is defined as the risk that at any time, ABL does not have or cannot generate sufficient cash resources to meet its financial obligations as they fall due or do so at significant costs. The assessment, monitoring and management of the Bank’s liquidity risk and strategy is done through the Asset and Liability Management (ALM) desk.

ALM acts as an independent risk management function and has the responsibility to control and manage the Bank’s liquidity risk in line with internally approved tolerance limits. The Bank also complies with the limits set by the Bank of Mauritius Guideline on Liquidity Risk Management.

As per the principles outlined in the Bank’s liquidity risk policy, the following approach is adopted to manage liquidity risk under both business-as-usual and stressed scenarios.

Short-term liquidity risk management Structural (longer-term) liquidity risk management Contingency Liquidity Risk Management Managing intra-day liquidity positions Identification of structural liquidity mismatches against tolerance limits and breaches escalated to ALCO Set appropriate liquidity buffers Monitoring daily and short-term cash flow requirements Managing term lending capacity through application of behavioural profiling of ambiguous maturity liabilities Undertake liquidity stress testing and scenario analysis Setting up of interbank and repo lines Monitor depositor concentration against internal limits and hold sufficient marketable assets against identified concentration risks. Setting of deposit rates according to market conditions and ALCO approved targets. Managing long-term cash flows -

STOCK OF LIQUID ASSETS

In order to protect the Bank against unpredicted disruptions in cash flows, the Bank maintains sufficient amount of liquid and marketable assets against internally approved limits.

The table below provides a breakdown of the Bank’s eligible liquid and marketable instruments as defined by the Basel Committee on Banking Supervision and the Banking Act 2004.

As at 30 June 2019 MUR'm Coins and bank notes 42 Excess cash with Central Bank 3,969 Short-term balances (less than 1 month) with banks in Mauritius 2,435 Short-term balances (less than 1 month) with foreign banks 43,914 Securities issued by sovereigns 33,572 As at 30th June 2019, the Bank’s liquid assets ratio was 79% against an internal limit of 25%.

-

DEPOSITOR CONCENTRATION RATIO

The Bank’s deposit base remains well diversified. As at 30th June 2019, the depositor concentration ratios were as follows:

MUR deposits Single depositor 4.94% Top 10 depositors 26.98% FCY deposits Single depositor 3.17% Top 10 depositors 13.57% -

LIQUIDITY COVERAGE RATIO

The Bank of Mauritius, in line with Basel principles, issued its Liquidity Coverage Ratio (LCR) requirements in November 2017 as part of the Guideline on Liquidity Risk Management.

The objective of the LCR is to ensure that a bank maintains an adequate stock of unencumbered high quality liquid assets (HQLA) that consist of cash or assets that can be converted into cash at little or no loss of value in private markets, to meet its liquidity needs for a 30 calendar day time period under a severe liquidity stress scenario.

Formula missing

BoM has adopted the following phased in approach to the LCR requirement:

As at 30th June 2019, the Bank was within regulatory LCR limits with a MUR LCR of 729%, a USD LCR of 232%, an EUR

LCR of 95% and a consolidated LCR of 350%.As from 30 November 2017 As from 31 January 2018 As from 31 January 2019 As from 31 January 2020 LCR in Mauritian rupees 100% 100% 100% 100% LCR in material foreign currencies 60% 70% 80% 100% Consolidated LCR 60% 70% 80% 100%

ENTERPRISE RISK MANAGEMENT

OPERATIONAL RISK MANAGEMENT

At AfrAsia, Operational Risk is Everyone’s Responsibility. Operational Risk (OR) is the risk of not achieving our strategy or objectives as a result of inadequate or failure in internal processes, people, and systems or from external events, which can lead to adverse customer impact, reputational damage, litigation or financial loss. Operational risk is inherent in the day-to-day operations, activities, products and services which the Bank offers.

The Bank has a well-defined structure for operational risk that complies with regulatory and best practice requirements and is aligned with the risk culture and the risk profile of its activities. This is supplemented through an operational risk charter and operational risk framework, which include the three lines of defense (Business Units, Control Units, and External Auditors) and involvement of senior management ensuring the coverage that all operational risks are efficiently managed across its activities.

The OR framework includes a risk control self-assessment (RCSA) process, risk impact likelihood matrix, key risk and control indicators, Early Warning Indicators(EWIs), a robust operational risk event management tool, an escalation process, scenario analysis, audit recommendations, external information sources (external events or industry reports) and operational losses process.

ABL continuously improve operational control procedures to keep pace with new regulations and best practices in the market through holistic follow up of risks and their mitigating controls.

ABL fosters awareness and knowledge of operational risks at all levels of the organization through its risk-pro culture. During the financial year 18/19, several training sessions were conducted using the e-learning platform (LMS) and face-to-face sessions addressed general knowledge of Operational Risk.

ABL calculates its minimum (Pillar I) operational risk capital requirement using the Basic Indicator Approach (BIA) where the capital charge is 15% of average gross income over the last 3 years.

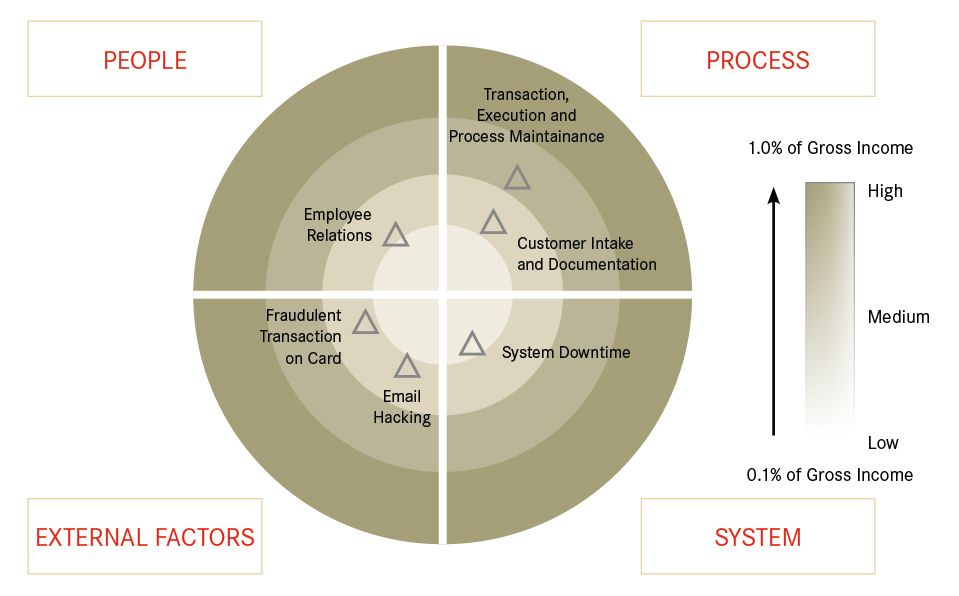

ABL has come up with an Early Warning Indicators (EWIs) for Operational Risk, which is 0.1% to 1.0 % of Gross income.

The Operational risk radar depicts the position of Operational Risk incidents with Operational losses according to the Basel Event Classification under the four quadrant; people, process, system and external factors vis-a-vis the Early Warning Indicators (EWIs).

INFORMATION TECHNOLOGY

With technology evolving faster than ever, the primary challenge for an enabling technology is to ensure that the Bank is adequately prepared and equipped to sustain the rigorous and continuous evolution of requirements for new technologies in the era of digital innovation and artificial intelligence, whilst managing the costs and the associated risks.

The Bank’s Information Technology (IT) and Information Security (IS) frameworks are built on global standards like ITIL, ISO 27001 etc. and the governance principles are modeled along the lines of COBIT, ISO/IEC 27014:2013. The practice of governance includes regular reviews with executive management and extends up to the Board with regular updates and feedback to and from the Board. Internal, external and regulatory audits play a crucial role in the governance cycle with intermittent checks on the policies and implementation of same.

BUSINESS CONTINUITY MANAGEMENT

Business Continuity Management (BCM) Policy includes plans to mitigate operational risks, and as a commitment to continue business to our shareholders, customers and employees. Business Impact Analysis, Business Recovery Strategies and Emergency Response plans are defined and implemented to provide for a Disaster Recovery site with data being updated as per preset recovery time objectives. This minimises operational, financial, legal, reputational and other material consequences arising from any disruption to the primary IT infrastructure.

The BCM policy reviewed in May 2019 is in line with the Business Continuity Institute Good Practice Guidelines 2018 (BCI GPG 2018), which is built on ISO requirements namely ISO 22301:2012 for business continuity management and ISO/TS 22317:2015 for Business Impact Analysis (BIA).

The management team of the Bank is committed to the following statement:

“We will take all necessary measures to ensure the continuity of business operations and to minimize recovery time in the case of disaster (natural or otherwise) or in the event of an emergency.”

The Bank has a BCM Steering Committee to review the processes after each testing exercise and to review the policy every year with a view to continuously improve resilience. The ultimate objective is to cater for any eventual disruption of operations to be restored within a minimum lapse of time such that the Bank resumes to normal operations within a reasonable time frame.

At least one BCM test is performed annually for all critical infrastructure involving all functions and user groups of the Bank to ensure the effectiveness of the processes and the readiness of the infrastructure and people. The Bank has adopted a cyclical approach residing on the four pillars: Readiness, Prevention, Response and Recovery /Resumption to continuously improve on the BCM and attain an efficient and acceptable level. Rigorous administration and maintenance, as well as any event experienced, will necessitate revisions and/or plan additions. The strategy adopted for an efficient BCM is to continuously test, train, evaluate and maintain the BCP.

The BCM policy is in place for moving towards a better resilient framework to protect the interest of all stakeholders of the Bank.

COMPLIANCE

Internal control and risk mitigation measures are put in place and implemented to ensure compliance with the relevant laws, regulations and internal policies and procedures.

As per the Compliance Plan approved by the Board of Directors, compliance reviews of departments are conducted on a regular basis. Reports/findings are duly submitted to Senior Management, Audit Committee of the Board and the Board of Directors.

Moreover, the Compliance Function is responsible to provide assurance and advise the Management and staff members concerning Compliance and regulatory matters. During this past financial year, the Bank further invested in capacity enhancement of the Compliance Function and is thus able to better assist and support internal customers.

The compliance culture of the Bank has been reinforced in line with regulatory requirements. The Customer On boarding Team (responsible for new clients being on boarded) and Compliance Team have been segregated (responsible for post compliance checks) for a better governance structure.

The Compliance Team will continue to provide support and advice to business lines, management and the Board and assist in regulatory matters. Furthermore, it will continue to provide ongoing training to relevant departments of the Bank.

CAPITAL STRUCTURE AND ADEQUACY

| AFRASIA BANK LIMITED | 2019 | 2018 | 2017 | |

|---|---|---|---|---|

| MUR'000 | MUR'000 | MUR'000 | ||

| Common Equity Tier 1 capital: instruments and reserves | ||||

| Share Capital | 3,641,049 | 3,641,049 | 3,157,608 | |

| Share premium (from issue of ordinary shares included in CET1) | - | - | 2,862 | |

| Statutory reserve | 692,398 | 454,679 | 339,711 | |

| Retained earnings | 1,836,242 | 1,277,521 | 944,373 | |

| Accumulated other comprehensive income and other disclosed reserves | 108,365 | 88,728 | 70,618 | |

| Common Equity Tier 1 capital before regulatory adjustments | 6,278,054 | 5,461,977 | 4,515,172 | |

| Common Equity Tier 1 capital: regulatory adjustments | ||||

| Treasury (Own Shares) | - | - | ||

| Other intangible assets | (243,398) | (249,585) | (155,855) | |

| Deferred Tax | (100,953) | (141,462) | (147,057) | |

| Significant investments in the capital of banking, financial and | ||||

| insurance entities that are outside the scope of regulatory | ||||

| consolidation, net of eligible short positions (amount above 10% | ||||

| threshold) | - | (151,650) | (113,738) | |

| Total regulatory adjustments to Common Equity Tier 1 capital | (344,351) | (542,697) | (416,650) | |

| Common Equity Tier 1 capital (CET1) | 5,933,703 | 4,919,280 | 4,098,522 | |

| Additional Tier 1 capital: instruments | ||||

| Instruments issued by the Bank that meet the criteria for inclusion in Additional Tier 1 capital | ||||

| (not included in CET1) | 1,323,552 | 1,360,715 | 1,340,467 | |

| Additional Tier 1 capital before regulatory adjustments | 1,323,552 | 1,360,715 | 1,340,467 | |

| Additional Tier 1 capital: regulatory adjustments | - | - | - | |

| Total regulatory adjustments to Additional Tier 1 capital | - | - | - | |

| Additional Tier 1 capital (AT1) | 1,323,552 | 1,360,715 | 1,340,467 | |

| Tier 1 capital (T1 = CET1 + AT1) | 7,257,255 | 6,279,995 | 5,438,989 | |

| Tier 2 capital: instruments and provisions | ||||

| Instruments issued by the Bank that meet the criteria for inclusion in Tier 2 capital (and are | ||||

| not included in Tier 1 capital) | - | 11,380 | 269,260 | |

| Provisions or loan-loss reserves (subject to a maximum of 1.25 percentage points of credit | ||||

| risk-weighted risk assets calculated under the standardised approach) | 463,159 | 415,825 | 381,347 | |

| Tier 2 capital before regulatory adjustments | 463,159 | 427,205 | 650,607 | |

| Tier 2 capital: regulatory adjustments | - | - | - | |

| Significant investments in the capital of banking, financial and insurance entities that are | ||||

| outside the scope of regulatory consolidation (net of eligible short positions) | - | (37,913) | (75,825) | |

| Total regulatory adjustments to Tier 2 capital | - | (37,913) | (75,825) | |

| Tier 2 capital (T2) | 463,159 | 389,292 | 574,782 | |

| Total Capital (capital base) (TC = T1 + T2) | 7,720,414 | 6,669,287 | 6,013,771 | |

| Risk weighted assets | ||||

| Credit Risk | 43,810,049 | 41,591,459 | 42,506,702 | |

| Market Risk | 499,978 | 332,436 | 440,288 | |

| Operational Risk | 4,404,267 | 3,421,490 | 2,988,502 | |

| Total risk weighted assets | 48,714,294 | 45,345,385 | 45,935,492 | |

| Capital ratios (as a percentage of risk weighted assets) | Regulatory Limits under Basel III | |||

| CET1 capital ratio | 9.38% | 12.18% | 10.85% | 8.92% |

| Tier 1 capital ratio | 10.88% | 14.90% | 13.85% | 11.84% |

| Total capital ratio | 12.88% | 15.85% | 14.71% | 13.09% |

RECONCILIATION WITH AFRASIA BANK’S AUDITED FINANCIAL STATEMENTS

| 30 June 2019 | ||

|---|---|---|

| Statement of Financial Position as in published financial statements | Statement of Financial Position as per Basel III | |

| Assets | MUR'000 | MUR'000 |

| Cash and cash equivalents * | 63,666,922 | 65,383,047 |

| Trading assets | 8,415,725 | 8,433,956 |

| Pledged assets | - | - |

| Derivative assets held for risk management | - | - |

| Loans and advances to banks | 6,019,048 | 6,009,188 |

| Loans and advances to customers | 22,150,196 | 22,131,334 |

| Derivative financial instruments | 92,413 | - |

| Financial investments-held for maturity | 36,892,446 | 36,901,673 |

| Investment securities | - | - |

| of which: Insignificant capital investments in financial sector entities exceeding 10% threshold | - | - |

| of which: Significant capital investments in financial sector entities exceeding 10% threshold | - | - |

| Property, plant and equipment | 185,675 | 185,675 |

| Intangible assets | 243,398 | 243,398 |

| of which: Goodwill | - | - |

| of which: Other intangible assets | 243,398 | 243,398 |

| Deferred tax assets | 100,953 | 100,953 |

| Other assets | 2,106,722 | 884,374 |

| of which: Defined benefit pension fund assets | ||

| Total assets | 139,873,498 | 140,273,598 |

| Liabilities | ||

| Deposits from banks | 30,434 | 30,434 |

| Deposits from customers | 131,208,365 | 131,208,365 |

| Derivative financial instruments | 49,995 | 49,995 |

| Trading liabilities | - | - |

| Derivatives liabilities held for risk management | - | - |

| Debt securities issues | - | - |

| Other borrowed funds | - | - |

| Subordinated liabilities | 184,205 | 184,205 |

| of which: Subordinated debt not eligible for inclusion in regulatory capital | 184,205 | 184,205 |

| of which: Subordinated debt eligible for inclusion in regulatory capital | - | - |

| Current tax liabilities | 112,116 | 112,116 |

| Deferred tax liabilities | - | - |

| Provisions | - | 463,159 |

| of which: Provision reflected in regulatory capital | - | 463,159 |

| Other liabilities | 571,979 | 561,502 |

| Total liabilities | 132,157,094 | 132,609,776 |

| Shareholders' Equity | ||

| Share capital and share premium | 5,026,817 | 5,026,817 |

| of which amount eligible for CET1 | 3,641,049 | 3,641,049 |

| of which amount eligible for AT1 | 1,323,552 | 1,323,552 |

| Retained earnings | 1,836,242 | 1,836,242 |

| Other reserves | 853,345 | 800,763 |

| Accumulated other comprehensive income | - | - |

| Total shareholders' equity | 7,716,404 | 7,663,822 |

The total asset book witnessed a growth of MUR 19.5bn for the year ended June 2019 versus the same period in 2018. The total risk weighted assets as at end of the current FY stood at MUR 48.7bn, demonstrating an increase of 7% in comparison to MUR 45.3bn as at end of June 2018. Despite the year-on-year growth of MUR 3.4bn in the risk weighted assets, the capital adequacy ratio rose from 14.71% to 15.85% as at end of June 2019, achieved through a net profit after tax recognised in retained earnings, as a result of a good performance of the Bank’s balance sheet. The capital adequacy ratio was well above the regulatory limit of 12.88% for the year 2019. The regulatory limit includes a capital surcharge of 1% in 2019, given that the Bank is classified as a Domestic Systemically Important Bank.

Analysis by risk type:

| Credit Risk | MUR 43.8bn |

| Market Risk | MUR 0.5bn |

| Operational Risk | MUR 4.4bn |

RELATED PARTY TRANSACTIONS, POLICIES AND PRACTICES

The Bank adheres to the Guideline on Related Party Transactions issued by the Bank of Mauritius in December 2001 (Revised June 2015). In line with this Guideline, the Board of Directors set up a Conduct Review Committee (CRC) to review and approve related party transactions. The Board has also adopted a policy, which sets out the rules governing the identification of related parties, the terms and conditions applicable to transactions entered into with them, and reporting procedures to the Board Risk Committee.

The BRC comprises of the chair/independent non-executive director, 1 independent non-executive director, 2 nonindependent non-executive directors and 1 executive director. This Committee is responsible for the approval of all Category 1 and Category 2 related party transactions, which are not exempted as per BOM guidelines (falling below 2% of Tier 1 capital).

All related party transactions are reviewed at the level of the CRC, which ensures that market terms and conditions are applied to such transactions. Those exceeding the 2% of Tier 1 capital is sent for approval while exempted transactions i.e. below the 2% of Tier 1 capital are reviewed in the quarterly meetings. Furthermore, all facilities granted to minority shareholders of AfrAsia Bank and exceeding 2% of Tier 1 capital, even not classified as Related Party as per BOM guidelines are reviewed by the BRC on a quarterly basis.

During the normal course of business throughout the year, the Bank entered into a number of banking transactions with its related parties. These include placements or loans to/from Banks, deposits as well as other normal Banking transactions. As at 30 June 2019, related party exposure was within regulatory guidelines at 19% (Cat 1 and Cat 2).

The Bank has complied in all respects to the Bank of Mauritius Guideline on Related Party Transactions. Related party reporting to the Bank of Mauritius is made on a quarterly basis. Moreover, all related party transactions (including those transactions, which are exempted as per the Guideline on Related Party Transactions) are monitored and reported to the CRC on a quarterly basis.